Acquisition project | Mokobara

Introduction

My product for Acquisition project is Mokobara.

I have 4 years of experience in strategy consulting, worked with ZS Associates and Deloitte USI. But I didn't want to take a B2B product, and rather wanted to pick a D2C brand. Hence I went ahead with Mokobara. I have never ordered the product for myself, but have purchased it for gifting purposes and I love the brand story and their products as well.

For user research, I created a google form which captured results from 30+ individuals. Further, to understand more about the users and (how + why) they ended up with Mokobara products, I interviewed more than 11 individuals.

About Mokobara:

Mokobara (https://mokobara.com/) is a luggage brand that aims to make travel more enjoyable and easier. The brand's name comes from the Maori word moko, which means "face tattoo" and represents personality and attitude, and the Swedish word bara, which means "to carry". Hence this brand is ideal to target GenZ and millennials with its quirky design and functionalities.

The brand was launched in 2019 and has quickly scaled from revenue of 8 cr in FY 22-23 to revenue of 200 cr in FY 23-24.

Mokobara's product portfolio includes:

- Luggage,

- Backpacks,

- Totes & Handbags,

- Travel accessories

The prices range from Rs. 5,000 to Rs. 15,000 with average selling price close to Rs 8,000/-

Marketing Campaigns Launched:

- Influencer marketing with Diljit Dosanjh and Deepika Padukone

- Launched a collaboration with Indigo, providing Mokobara luggage owners with 2kgs of extra luggage capacity

- Partnered with BlinkIt to provide Tatkal delivery (under 10 minutes delivery)

- Recently, they have partnered with Vobble to create a dent in kids category

ICP Selection

Below are the major ICPs cohorts I concluded from the survey and interviews:

Link of the survey conducted - https://forms.gle/vEzZg8zEdsCCNpXp7

| ICP 1 | ICP 2 | ICP 3 | ICP 4 | ICP 5 |

|---|---|---|---|---|---|

Ideal customer profile name | Ayushi | Pranav | Deepthi | Sreerag | Swetha |

Age | 22-35 | 25-35 | 27-50 | 25-35 | 22-35 |

Gender | Female | Male | Female | Male | Female |

Income levels | 80k + | 3 lakh + | 2-3 lakh + | 1 lakh + | 80k + |

Marital Status | Unmarried | Unmarried | Married | Unmarried | Unmarried/Married |

Location | Tier 1 | Tier 1 | Tier 1 | Tier 1 | Tier 1 |

Product(s) they have used ? | Everyday Backpacks | Suitcases, Travel Backpacks | Suticases, Travel Backpacks , Travel Accessories, Cabin | Travel Backpacks, Cabin luggage | Handbags, Tote bags |

Companies | Meesho, CRED, ZS, BCG, Mckinsey, Hotstar, Deloitte | Businessman, Startup CEOs, VPs | Agencies, Ogilvy, Dentsu, Schbang, | Tekion, Infosys, TCS, Oracle, SAP | Nykaa, Myntra, Fable Street, Nike |

Product is a need or a want ? | Want | Need | Want, need | Want | Want |

How did they hear about the brand ? | Instagram, Paid ads, Amazon | Colleagues, Same Industry, Instagram, Amazon | Instagram, FB, Amazon | Instagram, D2C website | Instagram, Myntra, Ajio |

Purpose of buying the product(s) ? | Short travel, Gifting to friends/ family, Office commute | Status symbol | Travel (short & long), Buying for Kids | Safety of laptop, High functionality | Office commute |

Where do they spend time? | Social media, LinkedIn, Twitter, Shopping, OTT | Networking, LinkedIN, Social media | Social media, Education Platforms, ET | Social media, Follows bloggers, Tech youtubers | Social media, Shopping, OTT |

Who do they follow ? (Travel Industry) | The rebel kid, Bruised Passports | Startup community, Investor Relations | Ajay sood, | Akash Malhotra, Geeky Ranjit, Anunay Sood | Shenaz, |

Influencers ? Why Mokobara ? | Minimalistic Design, Brand Appeal, Gifting | Expensive Product, Premium Brand | Design, Shape, Quality, Gifting | Functionality, Minimalistic Design, | Minimalistic, Shape, Colors |

Have people shown interest in the product/brand ? | Yes | NA | Yes | Yes | Yes |

Where do they search/shop for travel products ? | Amazon, D2C | Amazon, Retail Outlets | Amazon, Flipkart | Amazon, Myntra | |

Pain points ? (Pre and Post buying blockers) | Price is high | Need more limited edition products | - | Price is high, Bags are heavy, Need longer warranty | Quality can be improved |

Current solution | Waiting for discounts / Sale | Buys Samsonite / more premium brands | Retail stores, Carlton, | Wildcraft bags | High design, Tommy, ZARA |

Selecting the ideal customer profiles (ICPs) :

Summary of the user responses and interviews:

Users are facing brand fatigue and now wants to move towards unique and minimalistic designs. There is a growing demand for aspirational products as people have become aware (due to internet adoption, social media exposure) and have higher disposable income to spend. There are GenZ

ICP Prioritization matrix:

ICPs | Adoption Curve | Frequency | Appetite to Pay | TAM | Distribution Potential |

ICP 1 | High | High | High | High | High |

ICP 2 | High | Moderate | High | Low | Low |

ICP 3 | High | High | High | Moderate | Moderate |

ICP 4 | Moderate | Low | Moderate | Low | High |

ICP 5 | High | High | High | Moderate | High |

Basis the ICP prioritization matrix, 3 ICPs can be identified, highlighted in blue - I have broken down the ICPs in terms of the product offerings.

Below are the customer segments that we should target:

- Lifestyle product - Everyday Backpacks, Handbags,Travel accessories (ICP 1 & 5):

Age: 22-35

Average annual income > 15,000 $

Category: India 1 - Mexico, Poland, Singapore

Location: Tier 1 cities

Time Spent On: Instagram/FB, Google, Amazon, OTT

Looking for: Minimalistic designs, Brand appeal and Quality

- This segment of people have just started their career and have aspirations to buy premium products. Hence price point isn't a big factor for them.

- They work in companies like CRED, Nykaa, Myntra, Hotstar and follows latest trends and travel bloggers (Shenaz, Bruised passports)

- This segment also believes in gifting good quality premium products. Hence, 5 out of 11 interviews had purchased Mokobara products to gift to a friend / family member.

- Suitcases | Luggage (ICP 3):

Age: 27-50

Average annual income > 30,000 $

Category: India 1 - Poland, Singapore

Location: Tier 1 cities

Time Spent On: Social Media, Education platforms, Grocery shopping, Marketplaces, News

Looking for: Quality, Warranty, Design

- This segment of people have money and aspirations to purchase premium product. They are logical in their buying approach - and look at design, shape, form factor, quality, warranty of the products before buying.

- These are travel enthusiasts, mothers (buying suitcases for their kids), families, frequent flight travellers,

Mokobara Competitors:

Even though few articles on google suggest that VIP + American Tourister + Samsonite + Safari are competition of Mokobara, I completely disagree with this. Mokobara has an edge over these brands with its minimalistic deisgn, premium quality, and signature yellow lining. Also it falls under premium price segment, where only a few new D2C brands are competing. Samsonite has a higher price point for their laptop bags as well as suitcases, hence Mokobara can think of disrupting this space by launching luxury bag in the same price range as Samsonite.

Market Size:

Mokobara is aiming for a slice of the mid and premium segments, which make up about 30% of a Rs.20,000 crore industry, which is projected to grow at 10-12% CAGR.

Brands | Launch year | ASP | Pages/Visits | Semrush Ranking | Amazon Rating |

|---|---|---|---|---|---|

Mokobara | 2019 | Rs 8000/- | 3.3 | 41 | 4.5 |

Uppercase | 2018 | Rs 3500/- | - | - | 4.4 |

Assembly | 2017 | Rs 5000/- | 3.1 | 4.0 | |

Nasher Miles | 2017 | Rs 5000/- | 3.8 | 35 | 3.8 |

Samsonite | - | Rs 13000/- | 2.1 | 37 | 4.6 |

Carlton | - | Rs10,000/- | - | - | 4.6 |

As we can see below, sales growth of premium brands have been outperforming mass brands (in our example, Mokobara should try to eat up market share of brands such as Safari, American Tourister etc.)

Some brands operating in this sector:

What is the market size for affordable luxury travel products ?

Mokobara, which represents itself as a travel brand and not a luggage brand, is aiming for a slice of the mid and premium segments.

TAM

To calculate total TAM, we'll individually calculate TAM for our 2 ICPs

ICP 1: Travel Lifestyle products - Everyday Backpacks, Handbags, Travel accessories

Total population of India = 140 cr

Age group = 22-35

Market size remaining = 140 * 13 / 90 (a person can live upta 90 years)

= ~20 cr

This group of people are GenZ / Millennials i.e., working professionals with aspirations and budget for affordable luxury products.

% population living in Tier 1 cities ~35%

% working professionals in Tier 1 cities ~60% (Numbers are high in Bangalore/Pune (~72%), but low in Delhi/Mumbai (~55%), hence taking avg of 60%)

Market size remaining = 20 cr * 0.35 * 0.6

= ~4cr

Avg selling price of lifestyle products ~5k-6k

Hence, TAM = 4 * ASP (5k-6k)

~ 20,000 crore

ICP 2: Suitcases | Luggage

Total population of India = 140 cr

Assuming India can be divided in 3 segments: India 1, India 2, India 3 and affluent people live in India 1

India 1 segment = 10% people

(India 1 is the consuming class)

Market size remaining = 140 * 10% = 14 cr

Now, average selling price for suitcases is higher = Rs 12k - 15k, hence not everyone can afford these product.

Further dividing it into India 1A, 1B & 1C

Assuming India 1A and 1B can easily afford these product = 33%

Market Size Remaining = 14 cr * 0.33

= 4.5 cr

On average, each family have 4 people. Hence dividng the number by 4 to arrive at # households

Market Size Remaining = ~1 cr

Each house will have a mix of suitcases (cabin + Med/Large). Hence taking the AOV to be ~12k

Hence, TAM = 4 * AOV

= 4 * 12k

= 48,000 cr

Total TAM = TAM of ICP 1 + TAM of ICP 2

= 20k + 48k

Total TAM = 68,000 crores

SOM

Calculated TAM = 68,000 crores.

For lifestyle products:

Life of these products are not v high. On average a person change the bag/accessories in every 3 years.

Also, as we discussed above, this ICP caters to GenZ/Millennials who are working professionals, Females that want trendy tote bags.

Hence discounting competition from local brands, retails stores, Palika bazar etc i.e. assuming 50% of the population gets filtered here

SOM = 20k * 0.5

~ 10,000 crores

For suitcases/luggages:

Considering Tier 1 population who flies frequently, atleast twice a year ~60%, will be willing to purchase Mokobara products.

Also, life of these products are high. Suitcases ~7 years on avg. Hence people might not be willing to switch bags and suitcases if they have existing purchases.

Currently, VIP has 40% market share, Samsonite has 15% market share. Discounting competition and assuming Mokobara will initially grab 1/3rd of the market share

SOM = 48k * 0.6 * 0.33

~ 10,000 crores

Total SOM is ~20,000 crores for Mokobara

Core value of Mokobara: "Helping people travel places with comfort and style"

Mokobara is in early scaling stage :

Mokobara has successfully moved beyond the initial stages of product validation and now should focus on scaling the brand. Mokobara has found an amazing fit in the Indian industry, intelligently marketing their product and solving few issues mentioned below:

- Brand fatigue - The new generation does not relate to the brands that their parents use. They want to try out products from newer brands that they can talk to their friends about.

- Exclusivity - Aspirational customers pay for premium products to show off in social circles, or have a sense of prestige and distinction.

- High quality and functionality - Travelers, daily commuters are looking for new products that are more convenient to use and provides functionality

- Minimalistic designs - Indians have been influenced by the American and European culture for the longest period. Consumers have now started looking for minimalistic design, comfort - following the same trend as of Japan, Singapore.

Below are the 3 experiments that we can run to acquire more customers and increase brand presence and value.

Experiment 1 - Organic Growth

Experiment: Making customers feel special by giving them customized passport holders for free on shopping of 30,000 or above.

Example: Messy corners sells customized passport holders

During user interviews, many complained about Amazon, Ajio, and Flipkart charging a 12-15% margin on product listings. Users expressed that if the price is the same on the D2C website and marketplaces, they would prefer ordering directly through the D2C website.

We can start doling out these personalized passport covers for free to anyone who shops for more than 20,000.

Important features to take care of:

- Shopping cart value > 30,000

- Only available on D2C platform - www.mokobara.com

- Should have Mokobara signature branding - combination of MB, and yellow lining to keep it distinctive

Outcomes:

- Help create a feeling of exclusivity and prestige for the customers

- People taking international flights, ship tours etc. will help us organically promote Mokobara brand

- Sharing these personalized passport holders will incur a CAC of ~400 Rs. But, by shifting a customer from Marketplace to our D2C website will help save margin in excess of 5%

Experiment 2 - Partnership

Experiment:

- After speaking to several product users, 45% users had purchased the backpacks to gift to friend, families, colleagues. We can partner with aggregators like Qwikcilver, Tango, Giftcards India to implement gift card programs for customer engagement

- They can also partner with companies like Vantage circle, Bigsmall.in that focuses on rewards and recognition, employee benefits, wellness, and feedback solutions. Multiple MNCs have tie ups with Vantage circle. Ex: Deloitte, PWC, McKinsey etc.

Example: Qwikcilver

Qwikcilver can facilitate Mokobara’s entry into the corporate gifting market by offering bulk gift card solutions to businesses. Corporations often purchase gift cards in large quantities for employee rewards, holiday gifts, and client appreciation

Example: Vantage Circle

Vantage Circle can help Mokobara grow by leveraging its comprehensive employee engagement and rewards platform to enhance brand visibility, drive sales, and foster customer loyalty

Image: Partnering with Vantage Circle

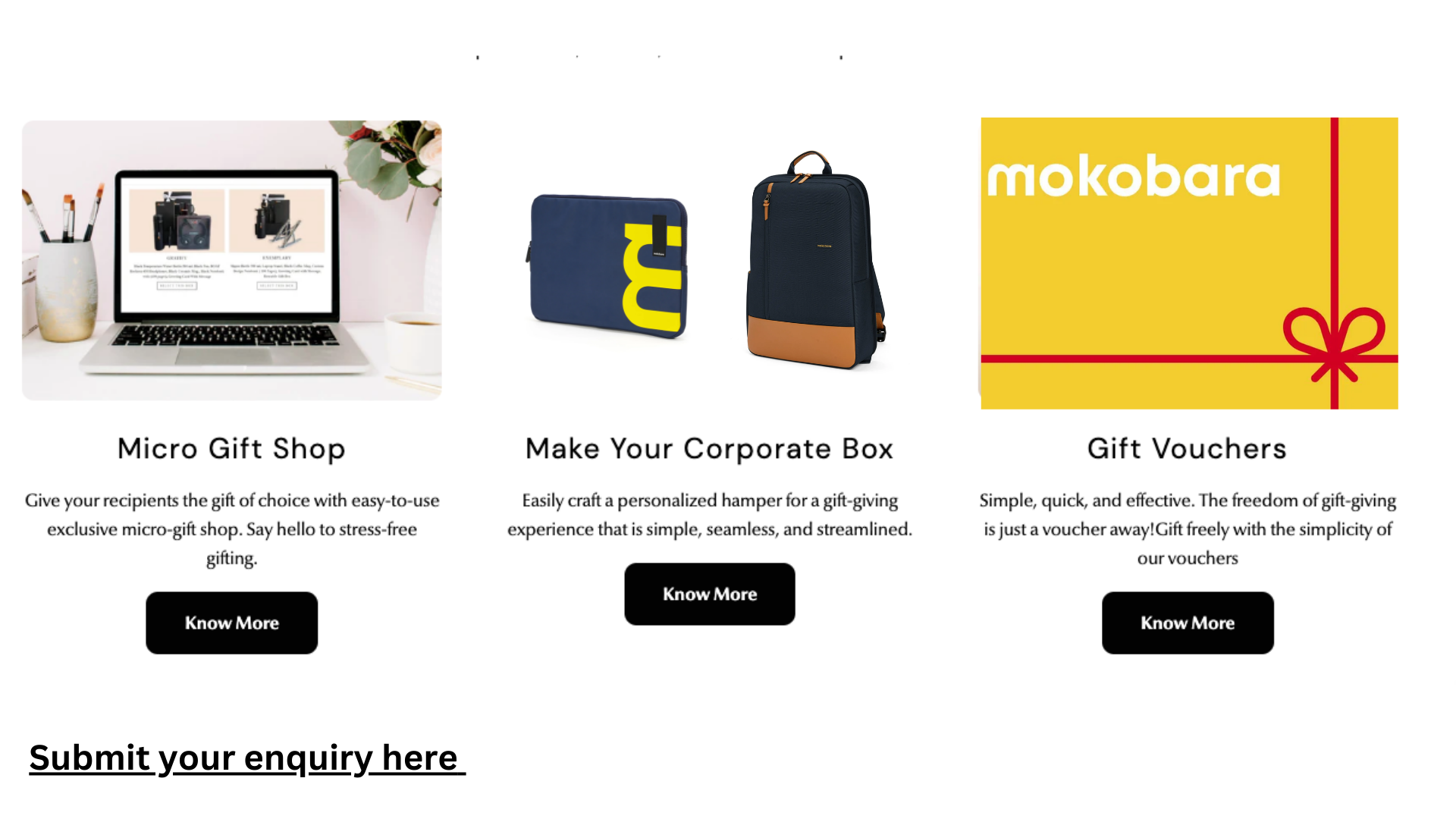

Image: Corporate gifting tab on www.mokobara.com

- Corporate Gifting Webpage

Experiment 3 - Organic SEO

Channel Overview:

Search Volume Comparison:

Type of search | Keyword/Search Queries | Search Volume | Difficulty to Rank on SEO | CPC | Keyword difficulty | Mokobara traffic |

|---|---|---|---|---|---|---|

Use Case | Suitcases | 67,380 | High | 0.74 $ | High | 20% |

Use Case | Carry on luggage | 101,380 | High | 1.03 $ | High | 1% |

Use Case | Duffle bag | 231,000 | High | 0.67$ | Medium | 0% |

Use Case | Leather backpack | 43,400 | High | 1.32$ | Low | 0% |

Competitor | Buy Nasher Miles bags | 39,787 | High | 0.27 $ | Low | 19% |

Competitor | Purchase Assembly bag | 2,560 | Low | 0.09$ | Low | 45% |

Your Product | Mokobara Travel backpack | 8,290 | Low | 0.84 $ | - | 100% |

Your Product | Mokobara Laptop bag | 2,100 | | 0.30$ | - | 69% |

Your Brand Name | Mokobara bags | 51,180 | High | 0.30 $ | - | 99% |

Your Brand Name | Mokabbara | 8,000 | Low | 0.15$ | - | 20% |

As observed in the table above, we can create article, product description pages for the below mentioned keyword searches:

- Leather backpack - Leather backpack has very high volume, so Mokobara can launch products made up of leather, and the search results will start picking Mokobara

- Carry on Luggage, Duffel bags - These both have v high search volumes, with Carry on luggage having a lower cost per click

- Mokabarra - Potential customers are searching for wrong name, and ultimately moving to a competitor website. We should start marketing for hygiene checks, publish articles on what "moko" and "bara" means, and mention how users often make spelling mistakes.

APPENDIX:

In the competitor section, we saw that Nasher Miles beats Mokobara with # visits / page. To understand the reason behind this, I tried to analyze what Nasher miles is doing differently in terms of marketing, promotions, onboarding etc.

Image 1: They have multiple discount schemes -> shop for 3k / 5k etc..

Image 2:

Similarly, there are providing vouchers of 200 rs on signups

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.